Make Cash Or Make Reasons - However You Can Refrain From Doing Both

Make Cash Or Make Reasons - However You Can Refrain From Doing Both

Blog Article

There was a time when I discovered myself often stating, I didn't have sufficient cash. And guess what? I didn't have adequate cash (I thought). I now discover I'm doing a similar thing with time - I do not have adequate time. Possibly you are as well - so I thought I 'd explore how to Enhance time management utilizing the Law of Tourist attraction.

The significant problem about following any of these systems is that it takes some time. Anyone who has truly succeeded in these models did not make their "fortunes" or supposed fortunes overnight. It took a great deal of difficult work and it took time.

To retire in 20 years with an income of $5000.00 per month, you would need to collect about 1.7 million dollars. Assuming a rate of return of ten percent (a bit positive for mutual funds these days), that would indicate saving about $1800.00 each month. Is that possible for many of us in today's economy? If you were only saving ten percent of your earnings, you would have to be making $216.000.00 per year. My previous jobs certainly did not pay that well.

First, I highly recommend entering into business on your own. You don't need to quit your day task yet to do it, either. There are a great deal of alternatives today to own and operate Internet-based companies, and you can do any of them in your extra time and even from your own couch!

Active Investor: The wealth creator takes complete duty for their wealth and is a smart, smart active investor - never a Passive Financier in the hands of a broker: a Financier not a Speculator; an Owner and not a Trader.

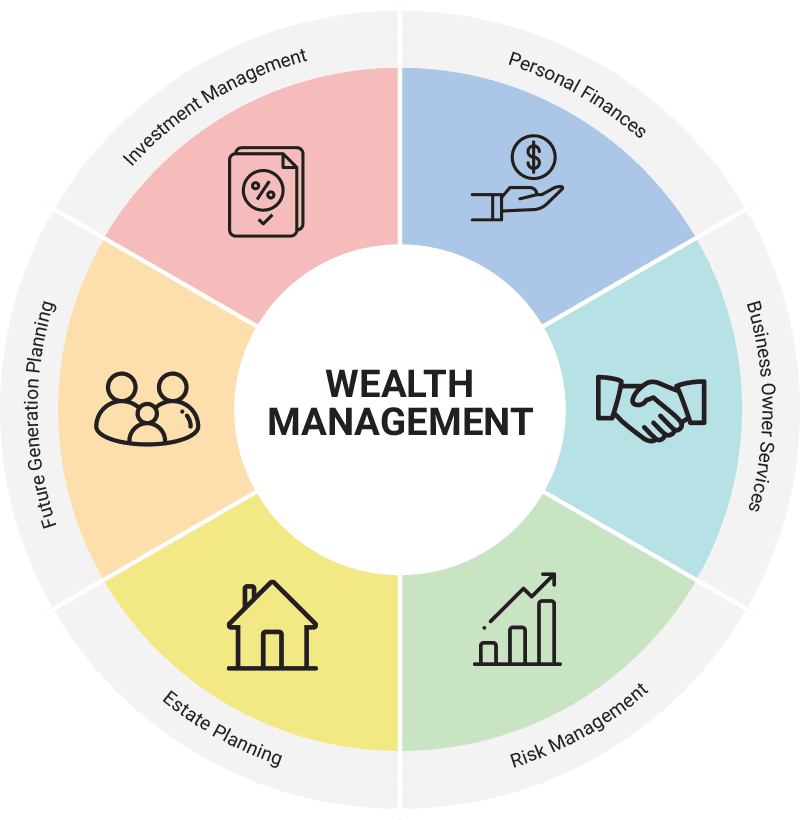

Cash makes the world go round. And that is why many people around the globe revolve their lives around jobs that pay their expenses. This is despite whether they work by the retail clock or 9-5 workplace hours. Correct wealth management is not simply about saving. It is also about planting your money in the best locations so that it works for you. Eventually, wise wealth management assists a specific to conserve, invest, and clear out financial obligation in a more effective manner.

So answering that question can make the distinction between getting here where you want to be-- or not. You need to become really clear about just what a "comfortable lifestyle" implies to you. Does it imply living in a villa in Beverly Hills? Or does it indicate living conveniently any place you wish to live, such as Costa Rica, for instance? The latter may wealth planning need much less cash than the previous.

So when you consider the future, what do you see? If you see a tiny minority of very rich people running the country (you might be looking at America today), you will wish to be among them. A wealth supervisor can make that take place.

Report this page